Wind Power Trading in Complex Terrrain:

The value of probabilistic forecasts for decision making?

Publication analyses for workshop data

2024-02-28 09:01:01

Ranking

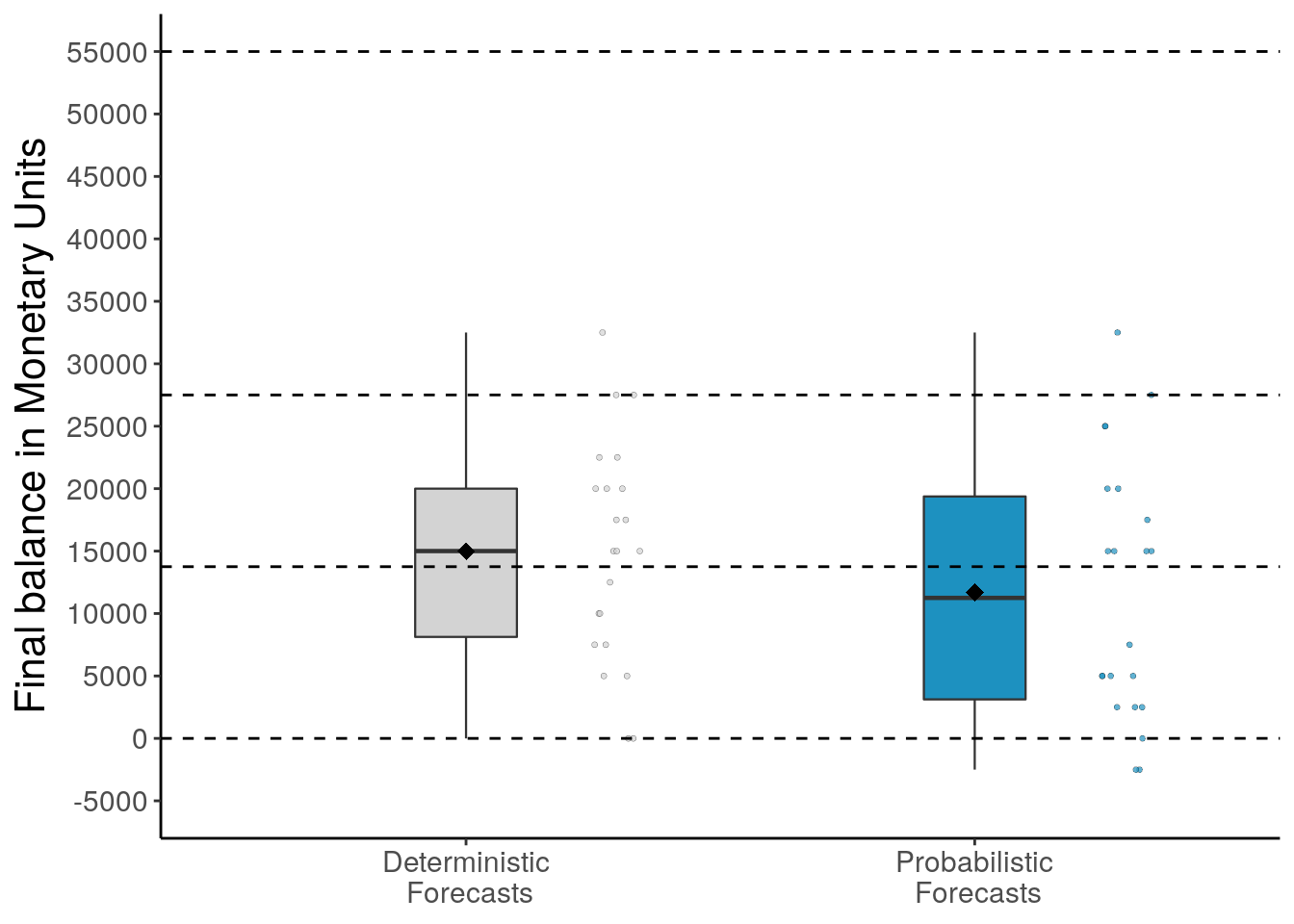

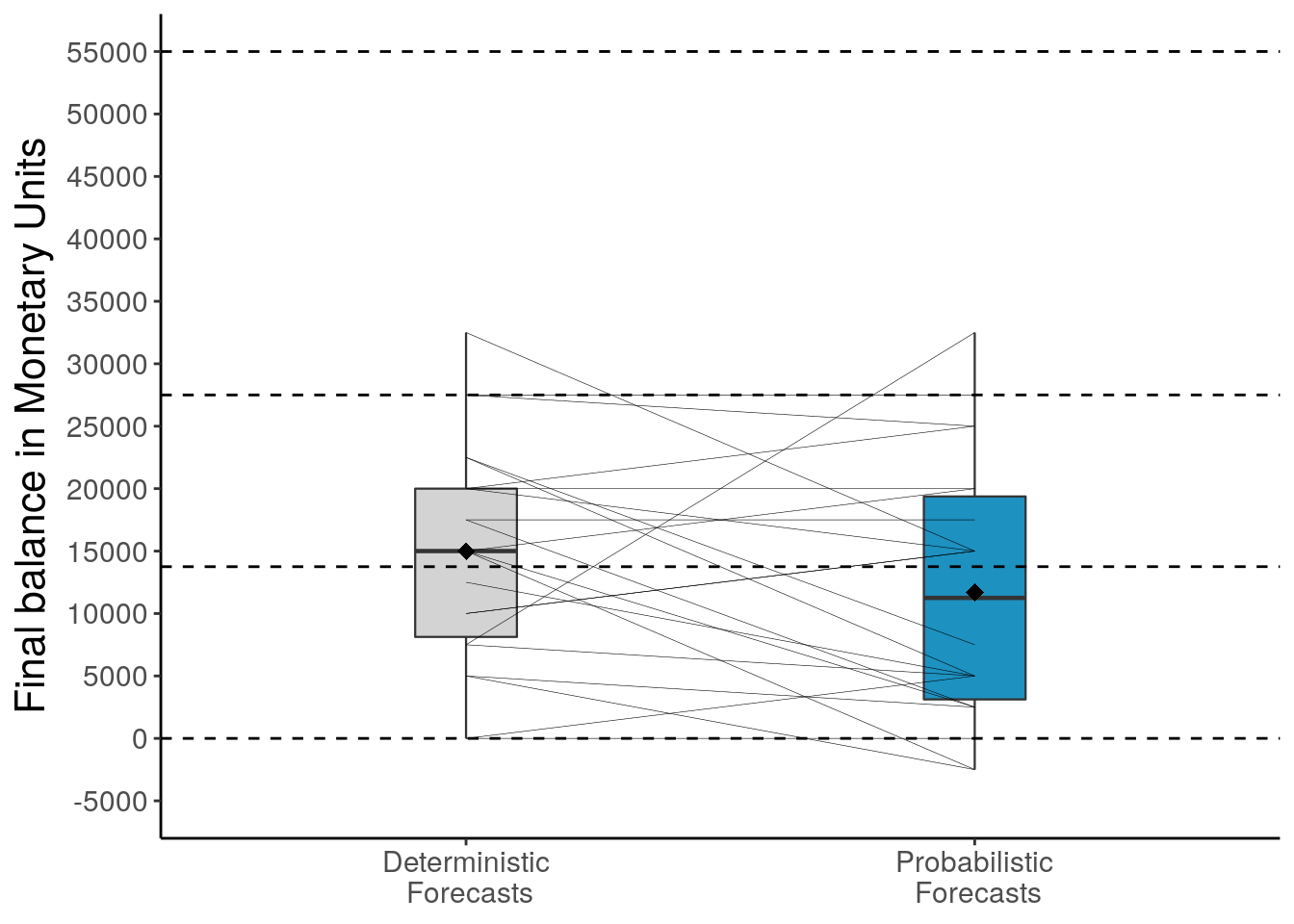

Final payoffs

Distribution of participants’ final payoffs for deterministic and probabilistic forecasts

# A tibble: 4 x 2

strategy finalBalance

<chr> <dbl>

1 allRisky 0

2 allSafe 27500

3 godseye 55000

4 chanceLevel 13750# A tibble: 2 x 4

forecast mean median sd

<chr> <dbl> <dbl> <dbl>

1 deterministic 15000 15000 8830.

2 probabilistic 11705. 11250 10333.

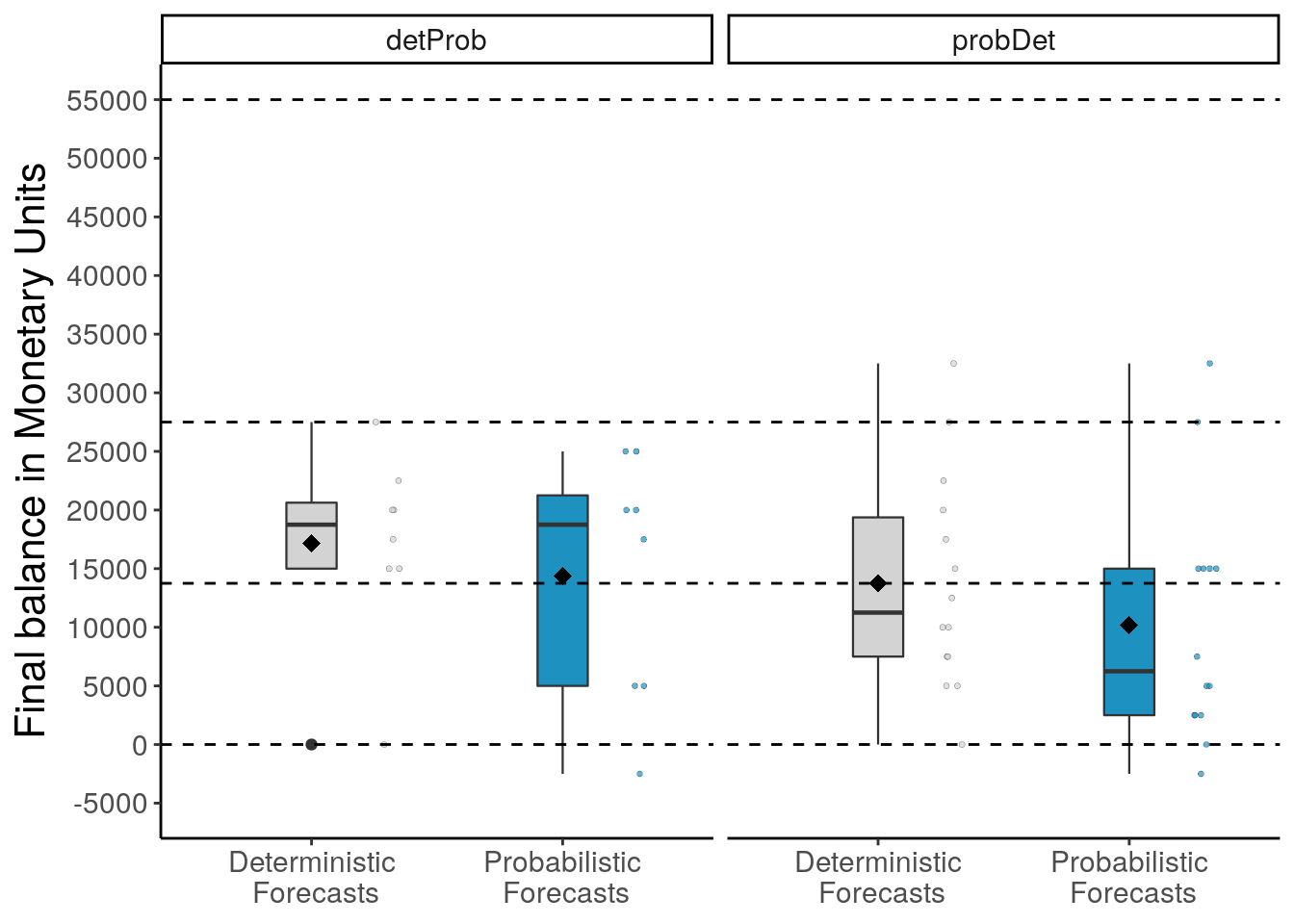

# A tibble: 4 x 5

# Groups: forecast [2]

forecast orderBlocks mean median sd

<chr> <chr> <dbl> <dbl> <dbl>

1 deterministic detProb 17188. 18750 8066.

2 deterministic probDet 13750 11250 9290.

3 probabilistic detProb 14375 18750 10415.

4 probabilistic probDet 10179. 6250 10353.

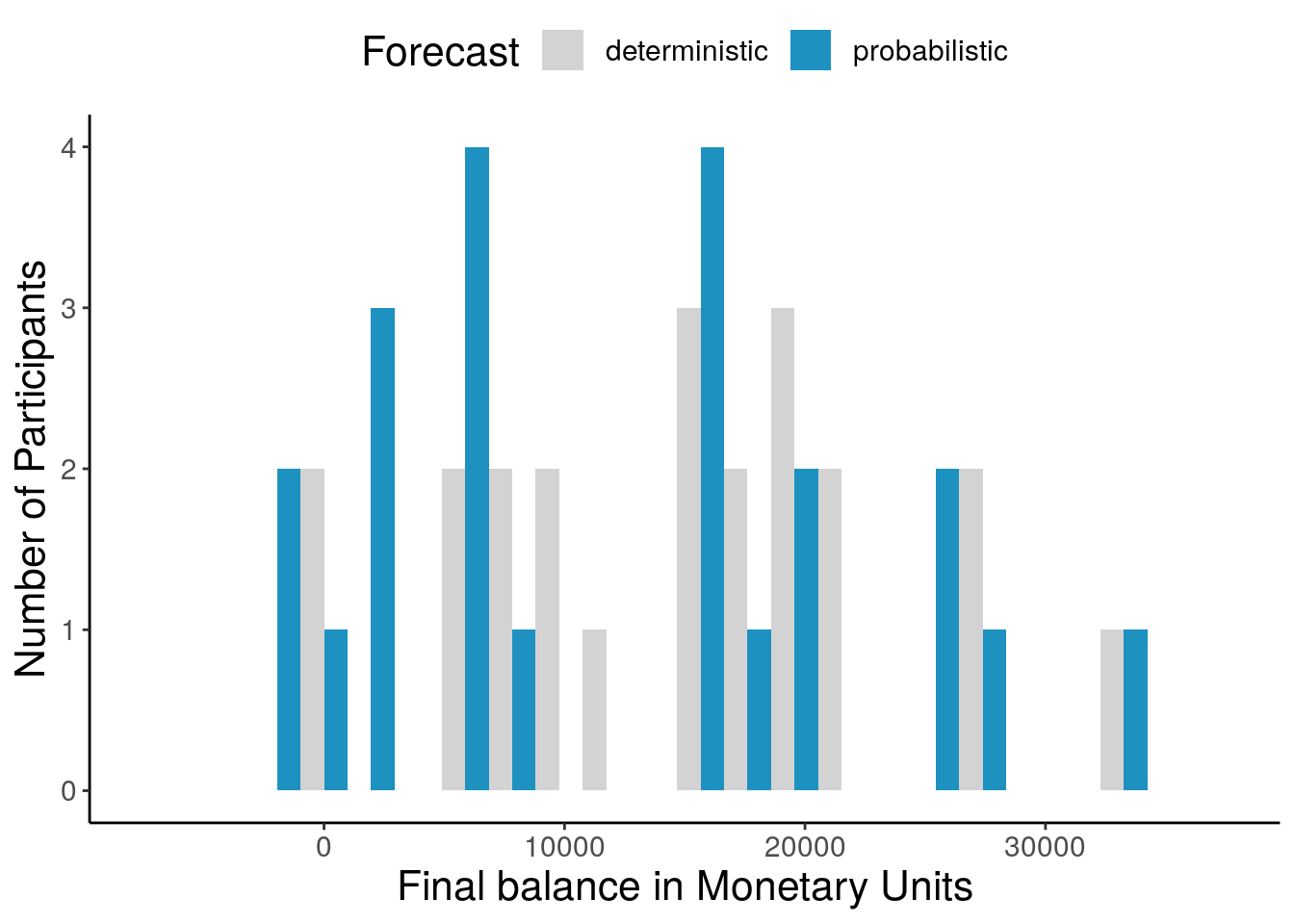

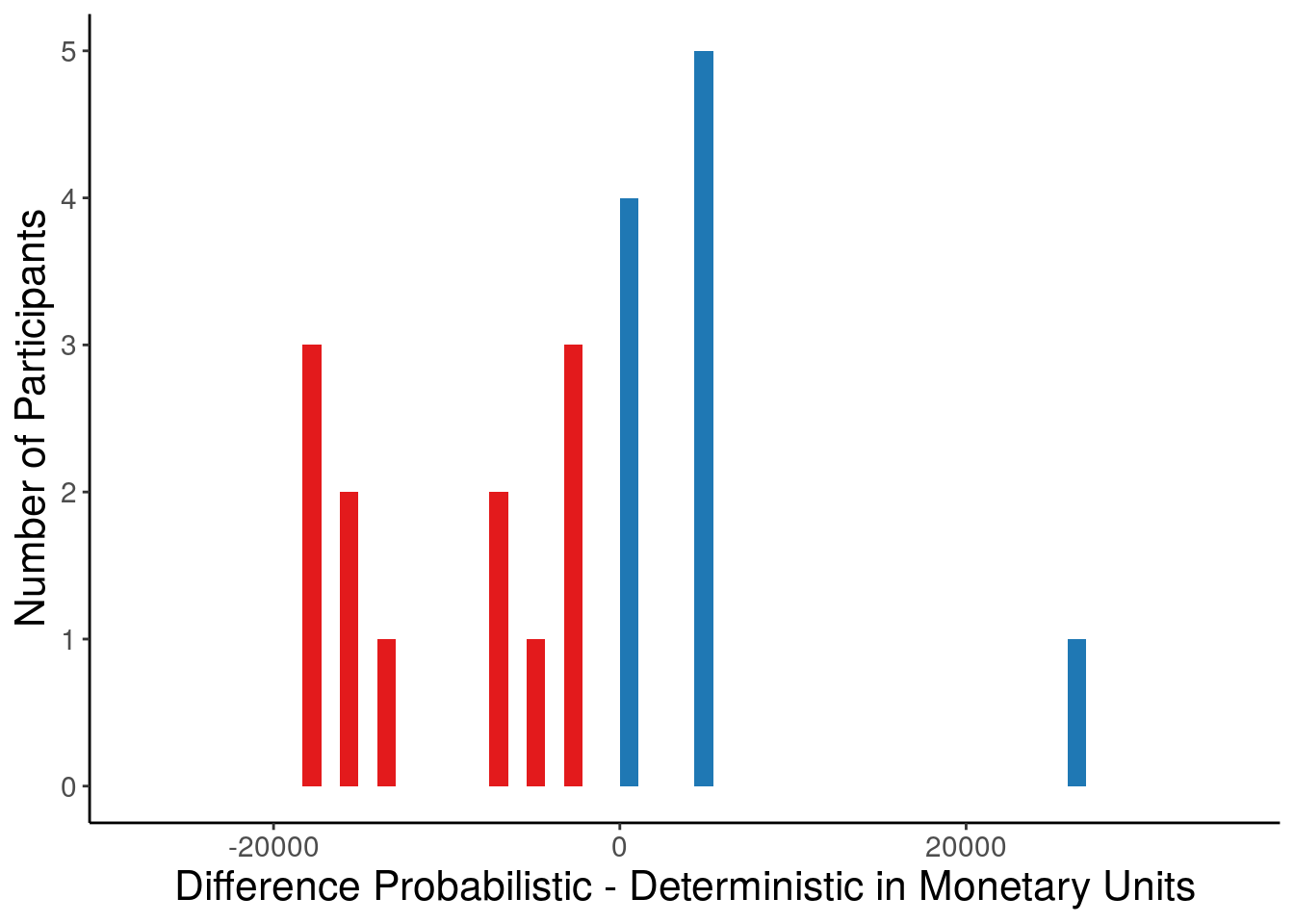

Benefit of probabilistic forecasts

Histogram based on the difference between each participants final payoffs based on probabilistic minus deterministic forecasts.

Positive values mean higher final payoffs with probabilistic forecasts, negative values mean higher payoffs with deterministic forecasts.

Min. 1st Qu. Median Mean 3rd Qu. Max.

-2500 3125 11250 11705 19375 32500 Min. 1st Qu. Median Mean 3rd Qu. Max.

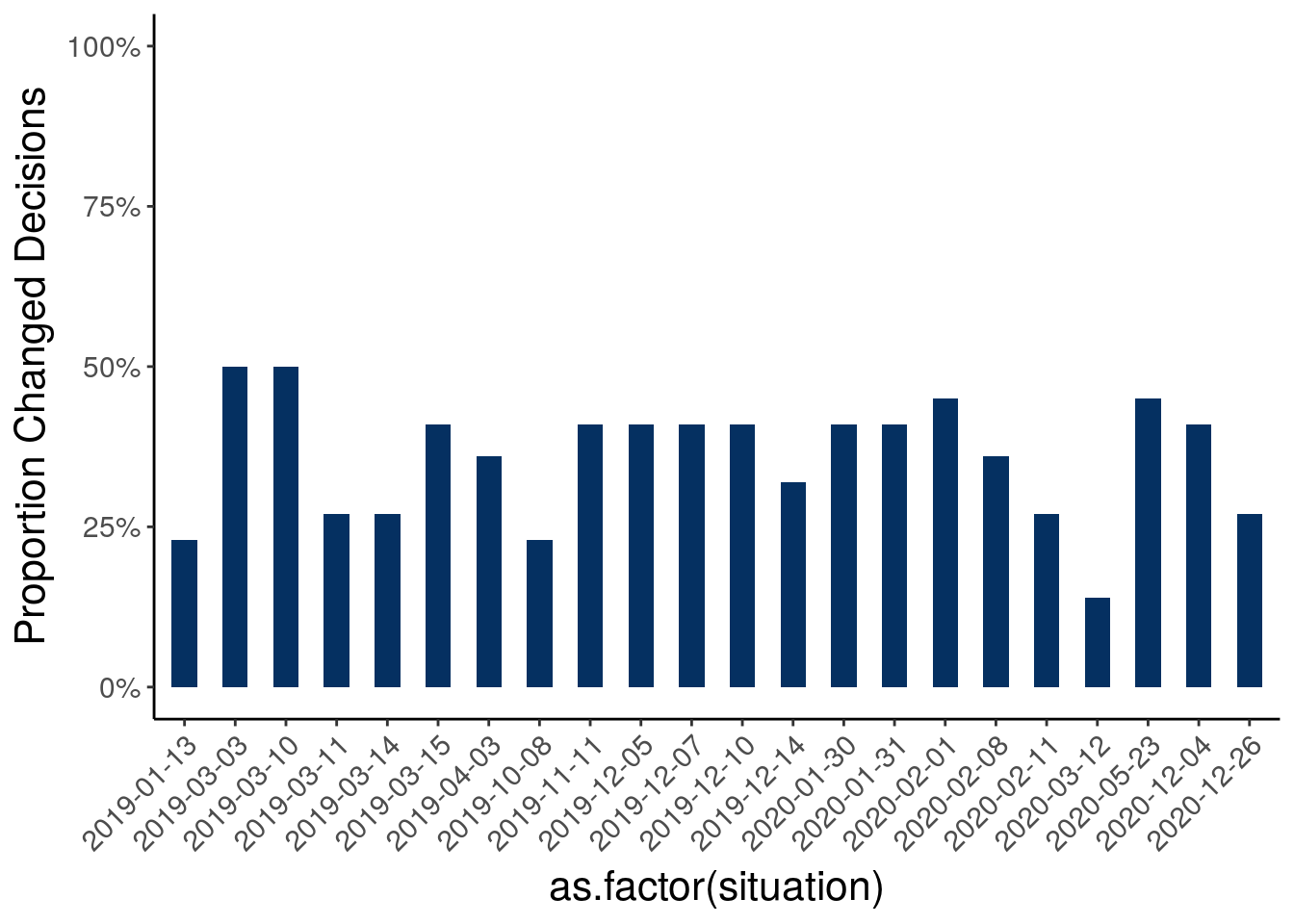

0 8125 15000 15000 20000 32500 Proportion different decisions

Proportion different decisions with deterministic vs. probabilistic forecasts

# A tibble: 2 x 3

changed n proportion

<chr> <int> <dbl>

1 change 174 0.360

2 noChange 310 0.640NULL

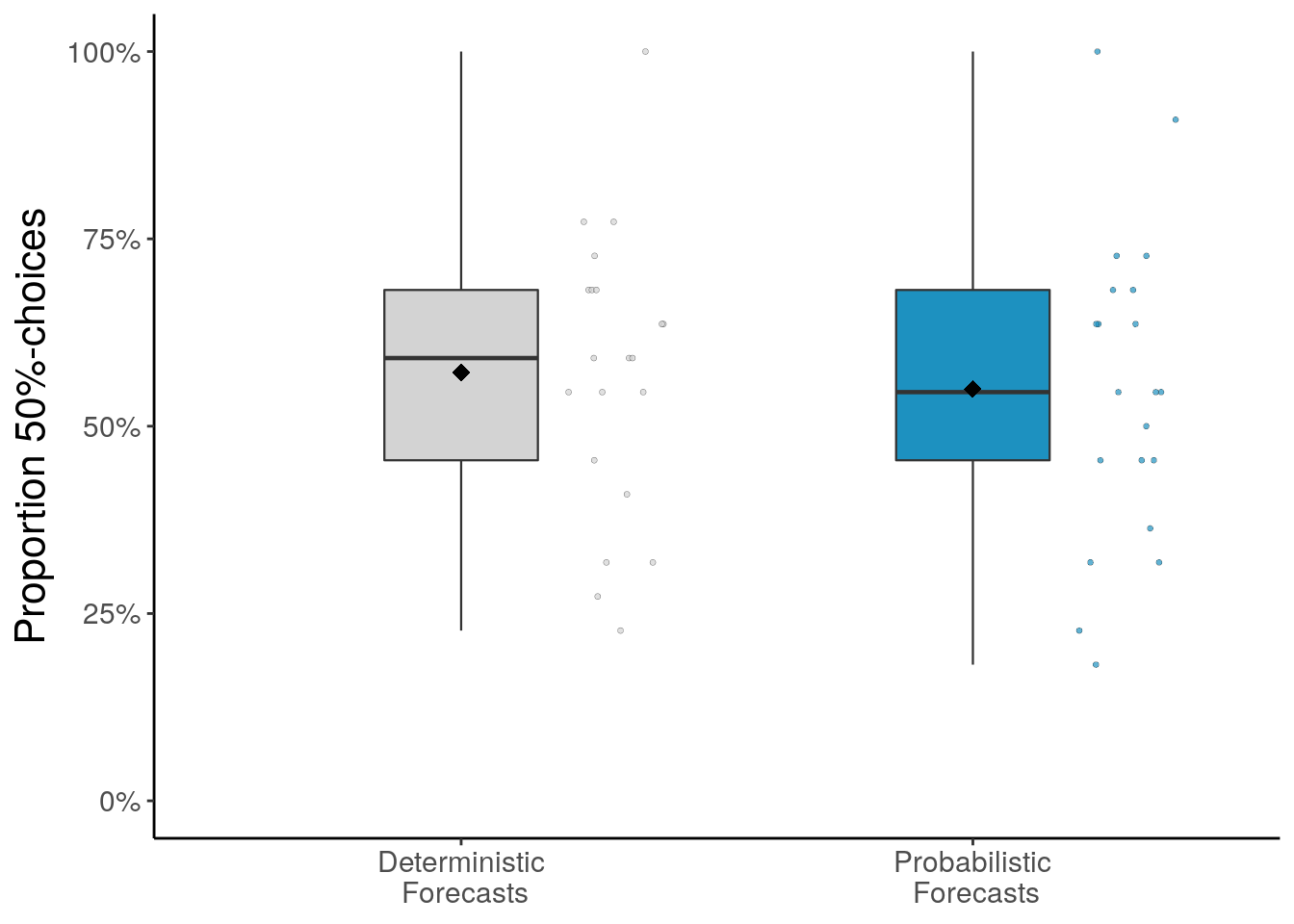

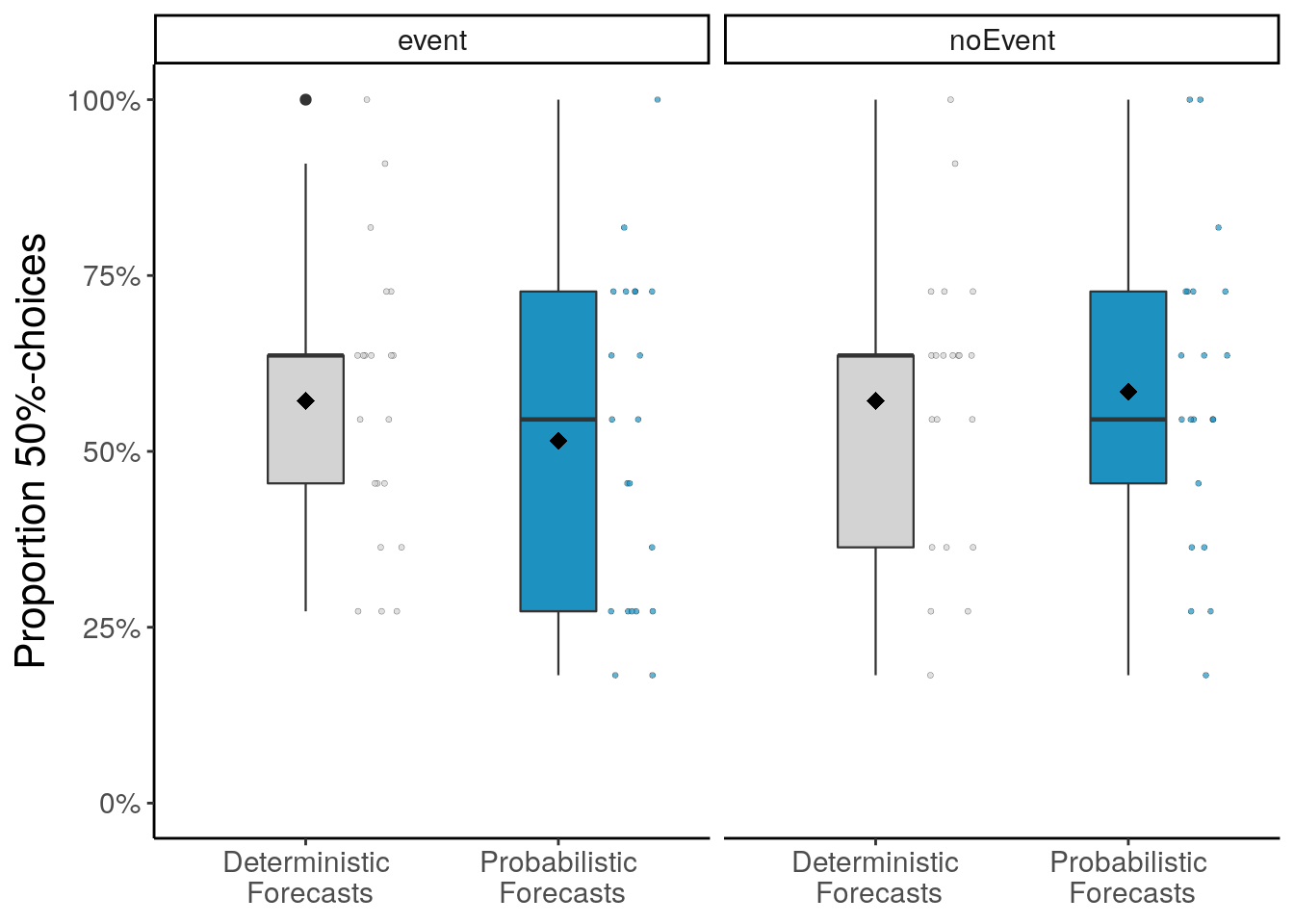

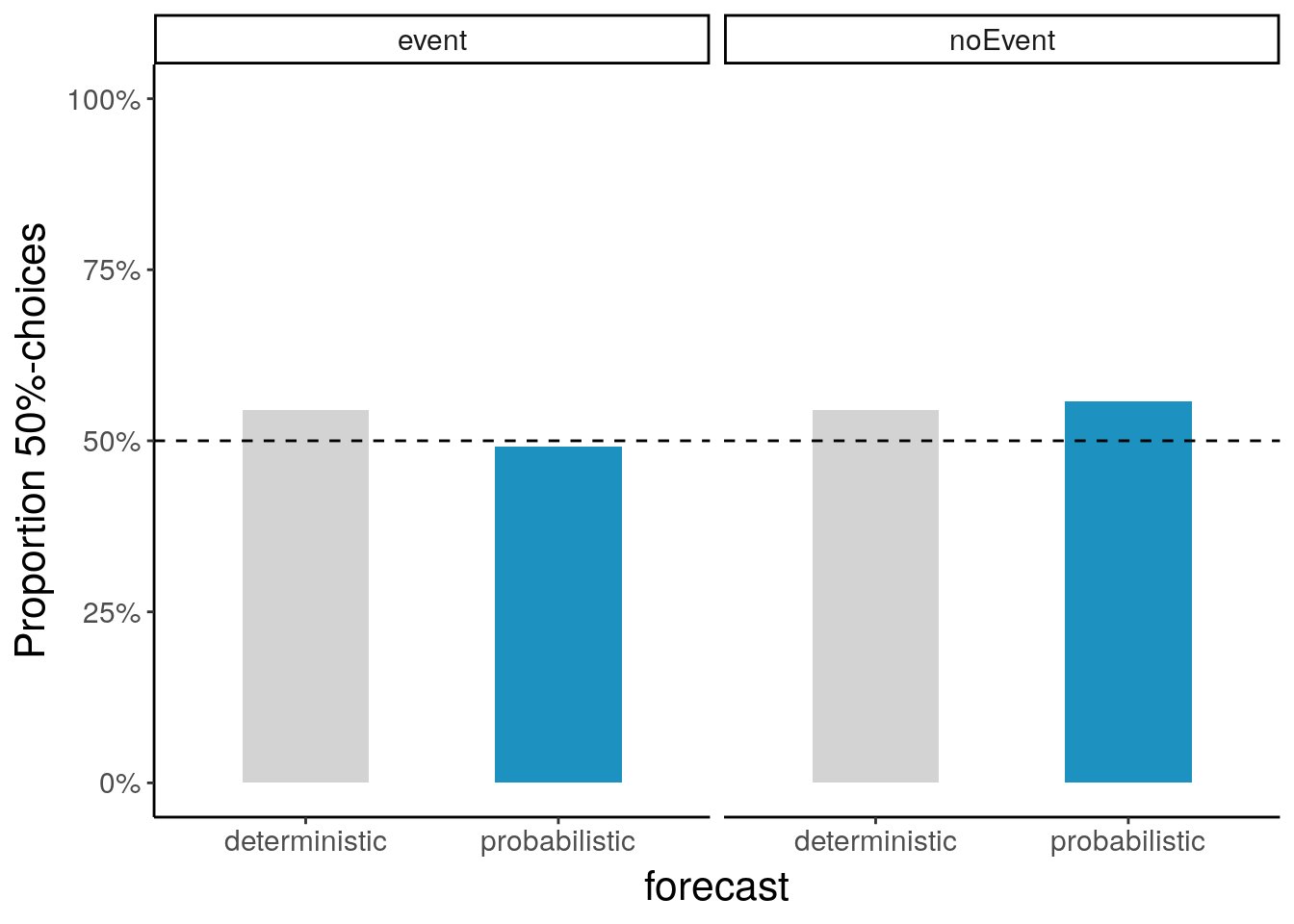

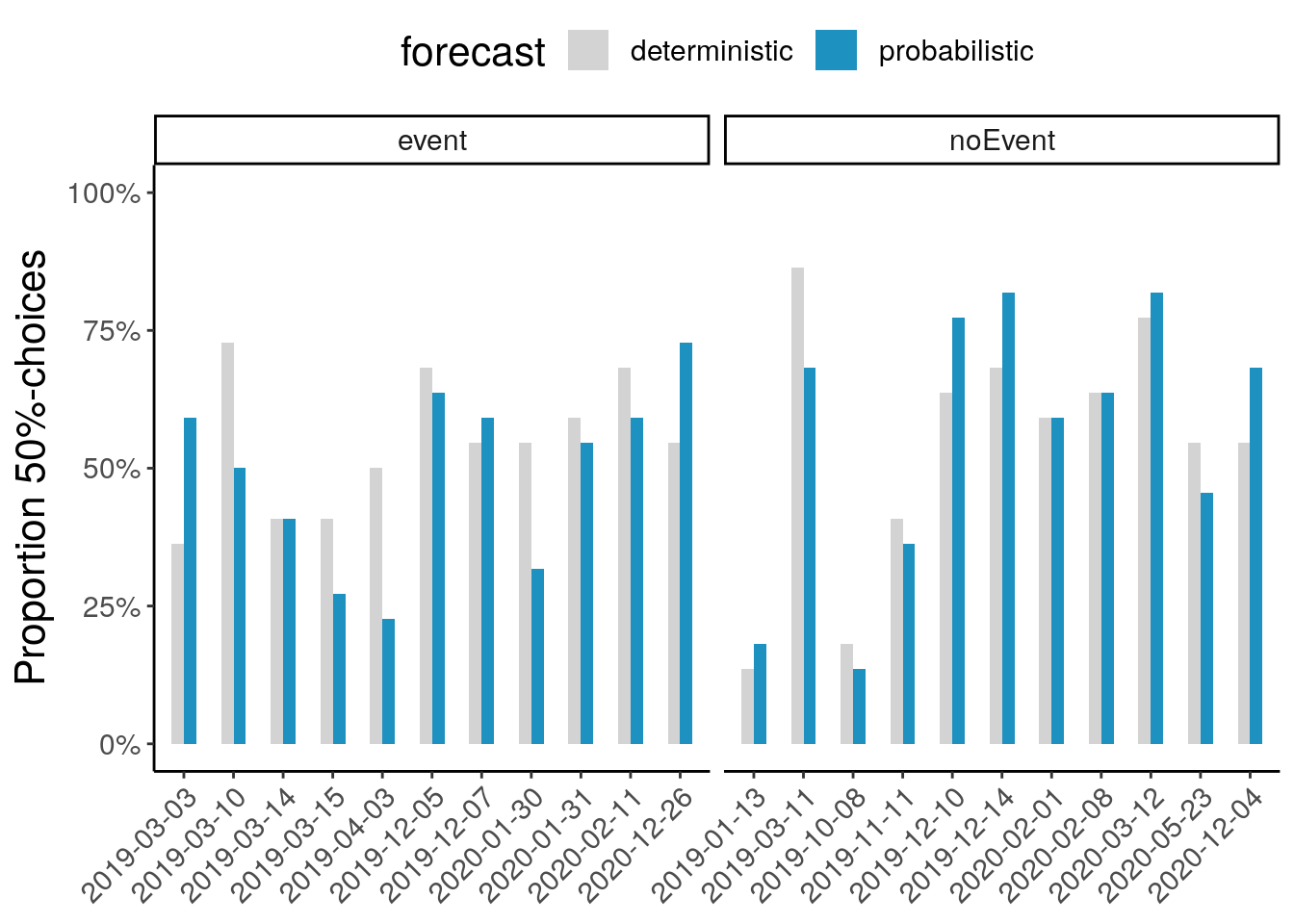

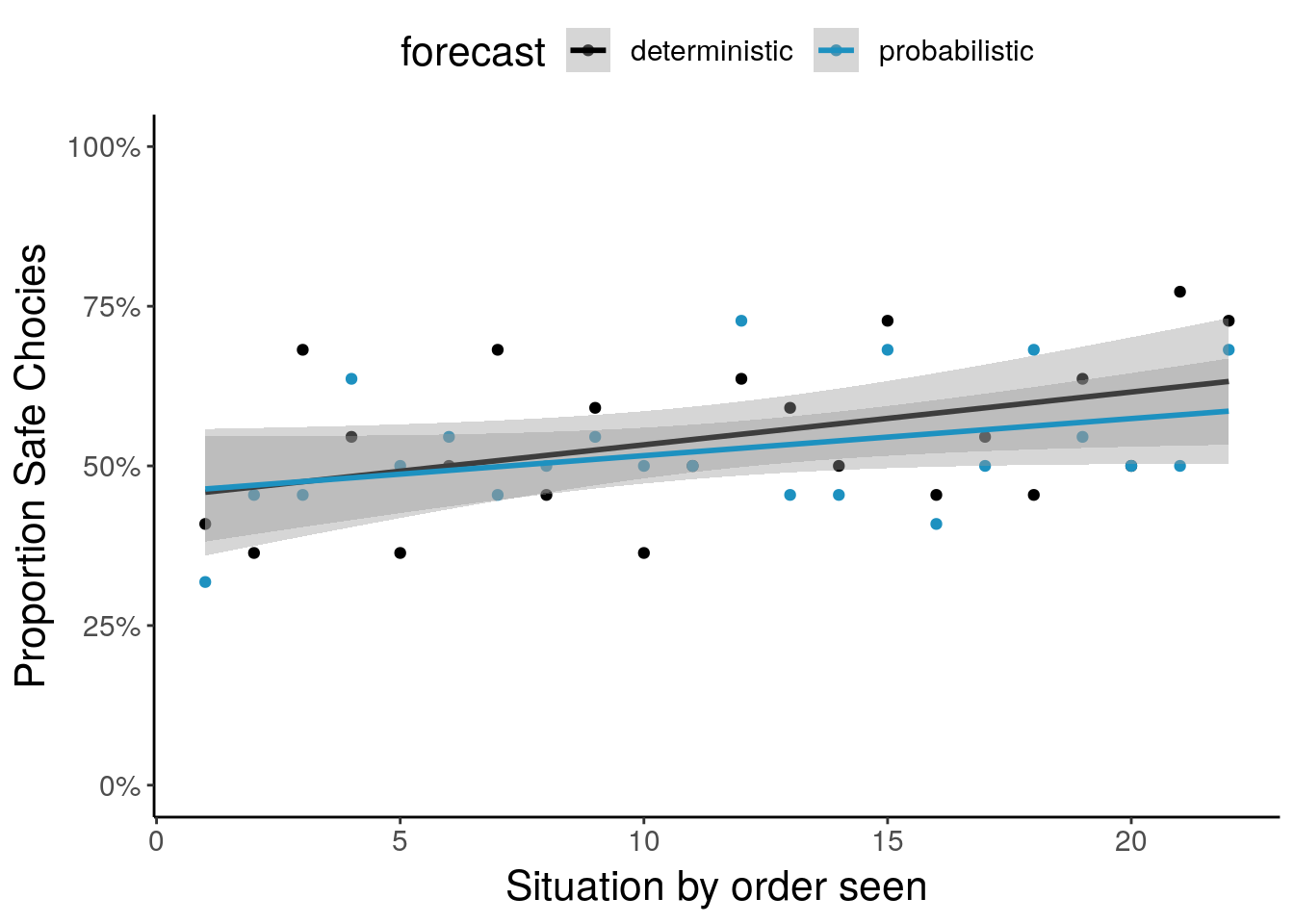

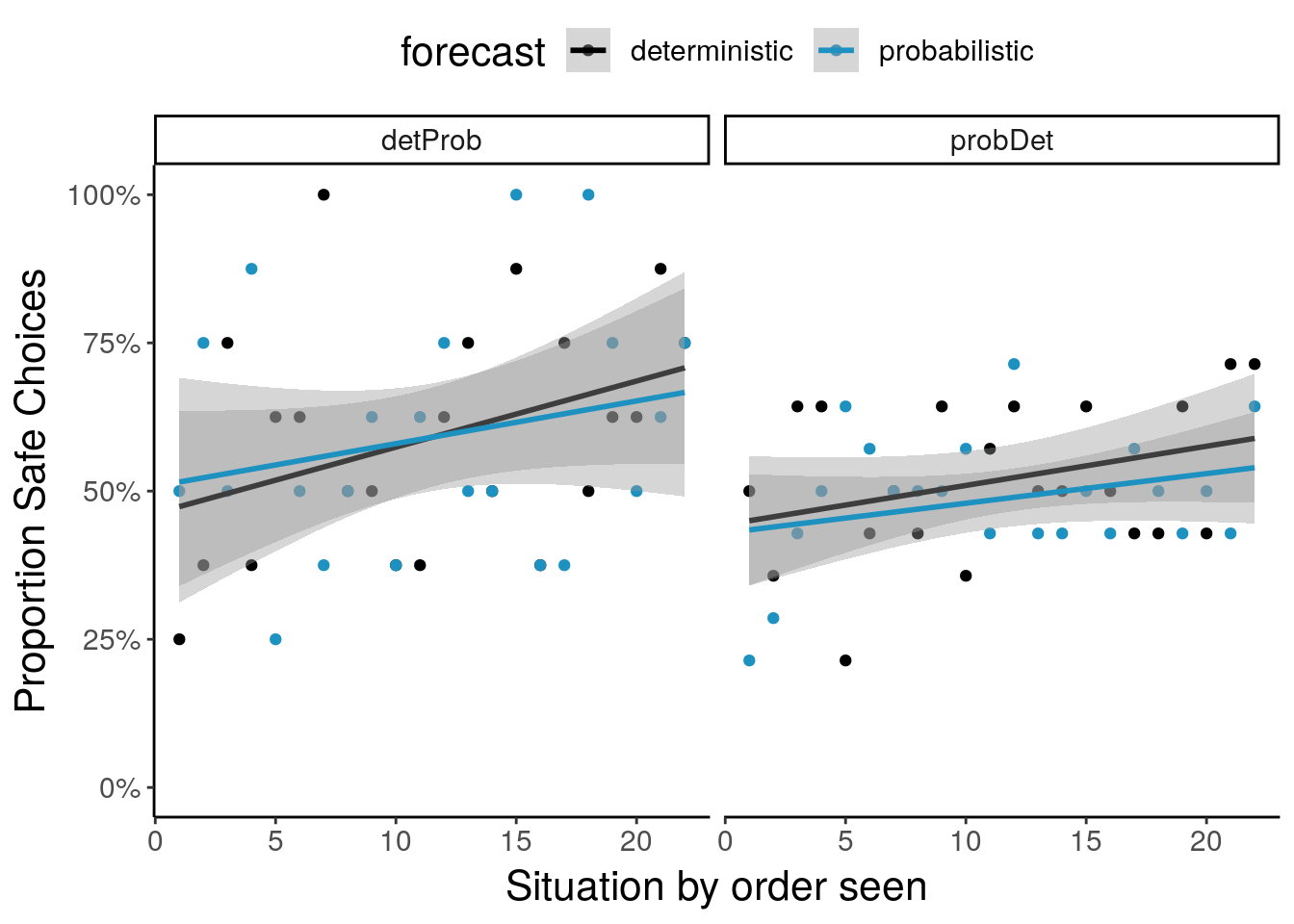

Proportion safe decisions

Proportion of safe decisions ("trading 50%) with deterministic vs. probabilistic forecasts

# A tibble: 2 x 3

forecast median mean

<chr> <dbl> <dbl>

1 deterministic 0.591 0.571

2 probabilistic 0.545 0.550

# A tibble: 84 x 6

# Groups: subID, forecast, event [88]

subID forecast event riskyDecision n proportion

<int> <chr> <chr> <chr> <int> <dbl>

1 4048 deterministic event no 11 1

2 4048 deterministic noEvent no 11 1

3 4048 probabilistic event no 11 1

4 4048 probabilistic noEvent no 11 1

5 4049 deterministic event no 5 0.455

6 4049 deterministic noEvent no 4 0.364

7 4049 probabilistic event no 3 0.273

8 4049 probabilistic noEvent no 7 0.636

9 4050 deterministic event no 6 0.545

10 4050 deterministic noEvent no 6 0.545

# … with 74 more rows

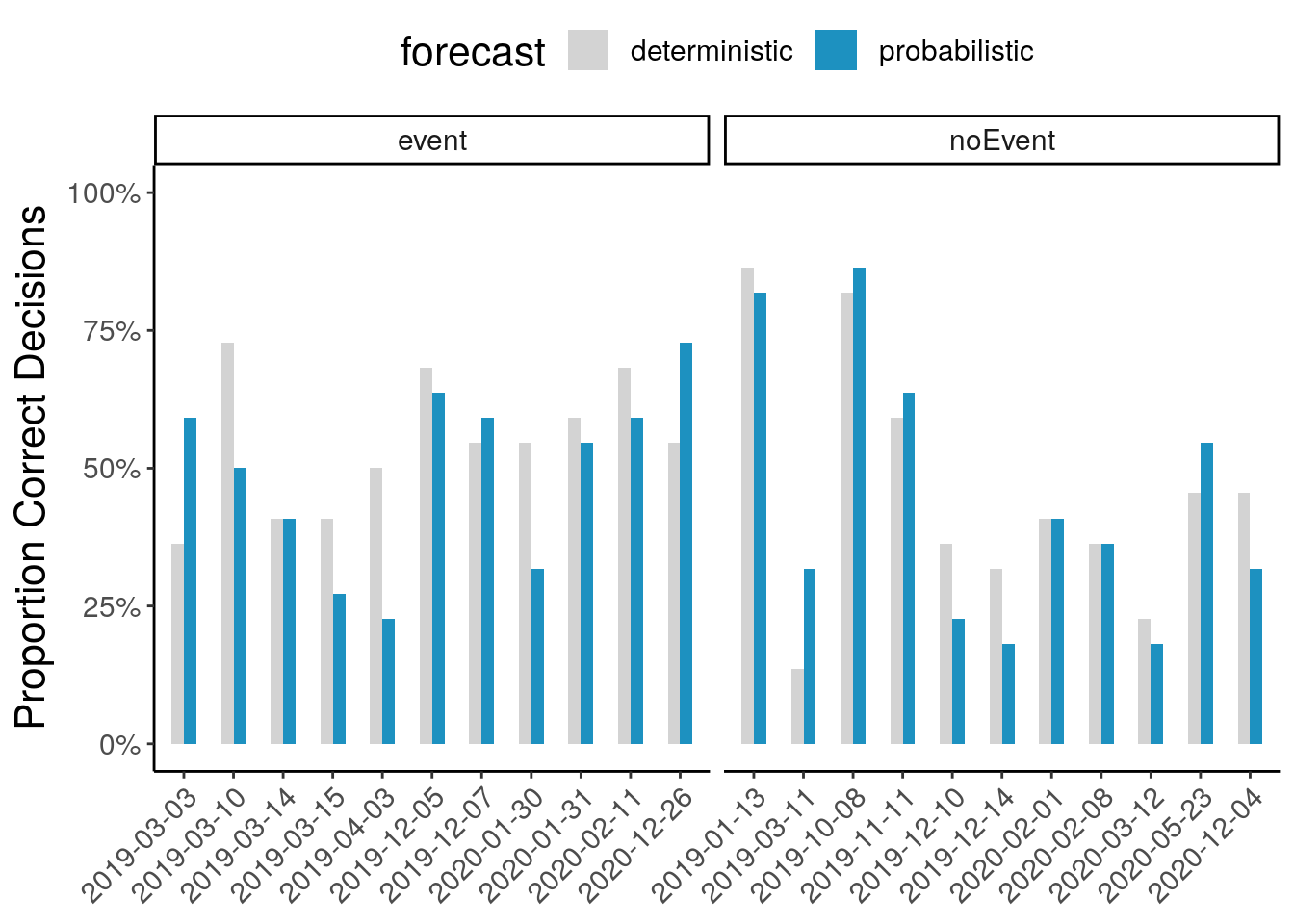

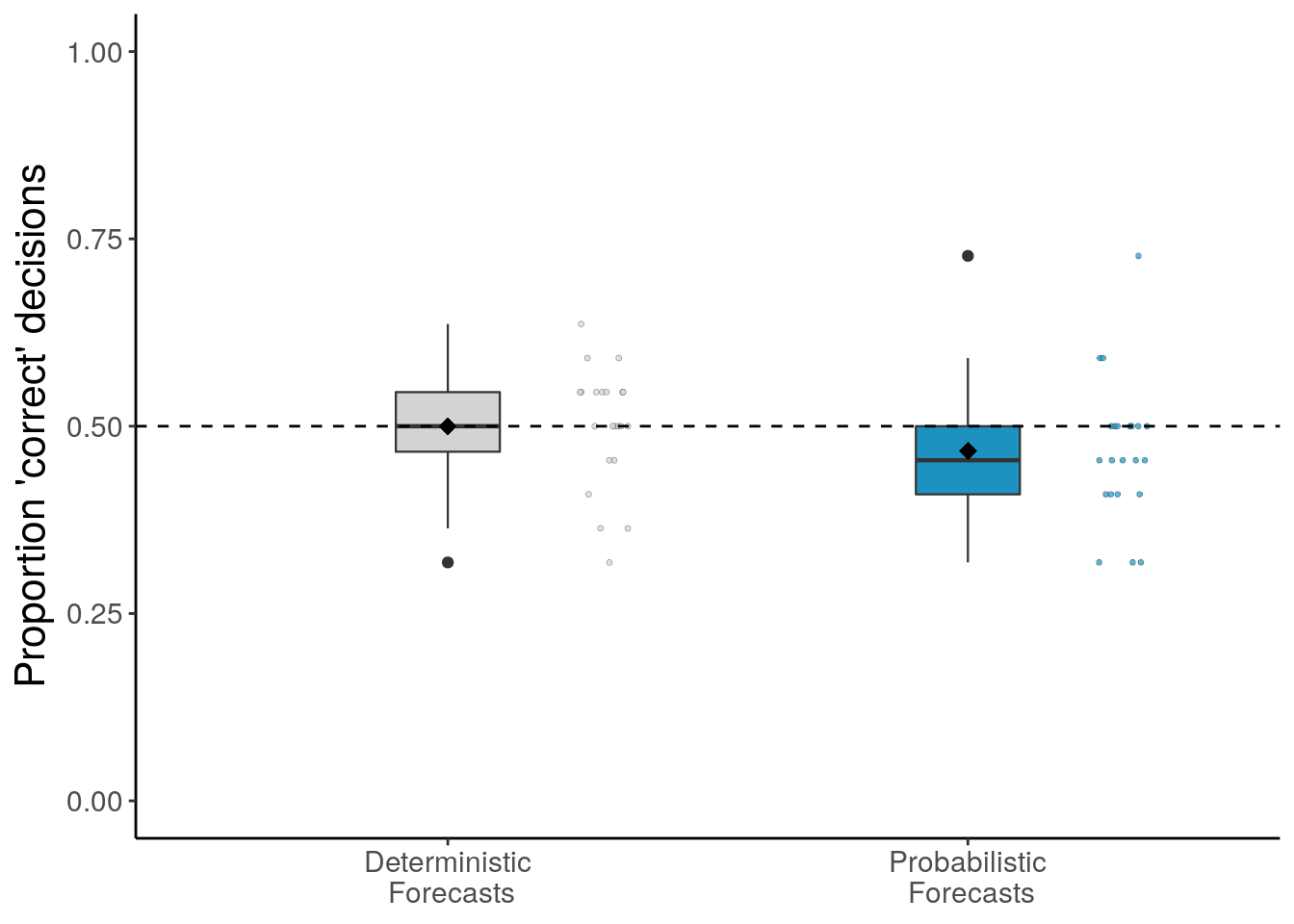

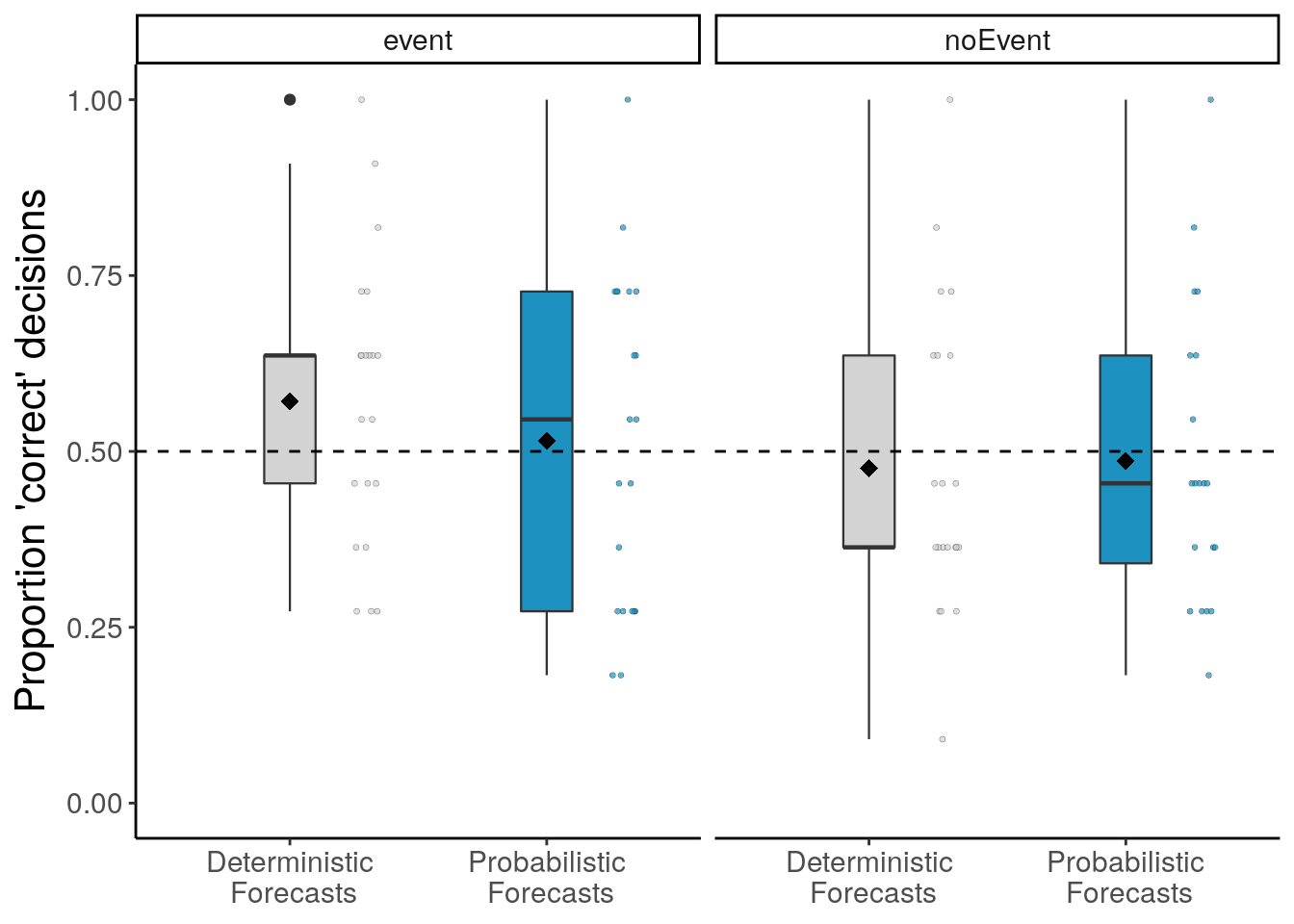

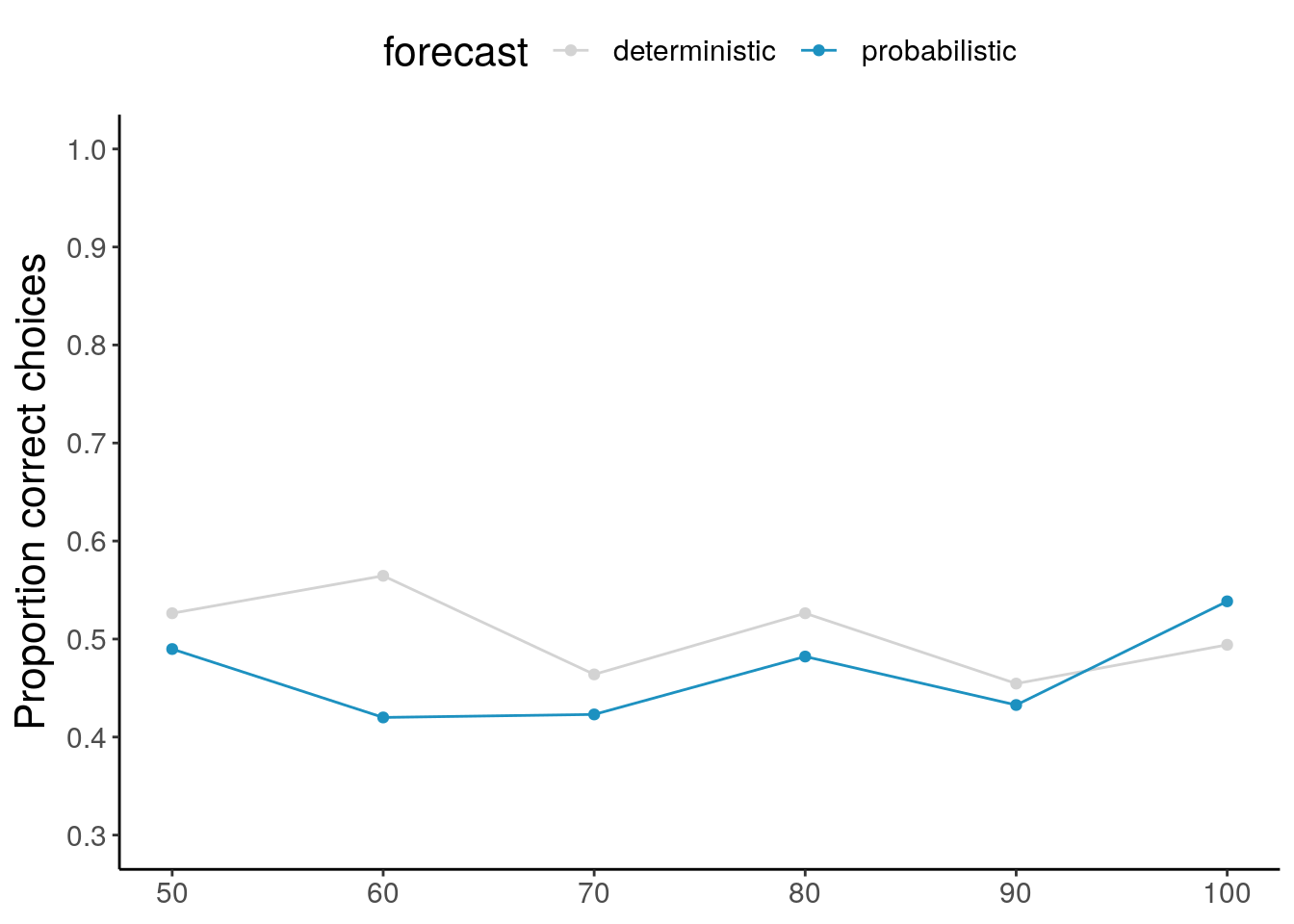

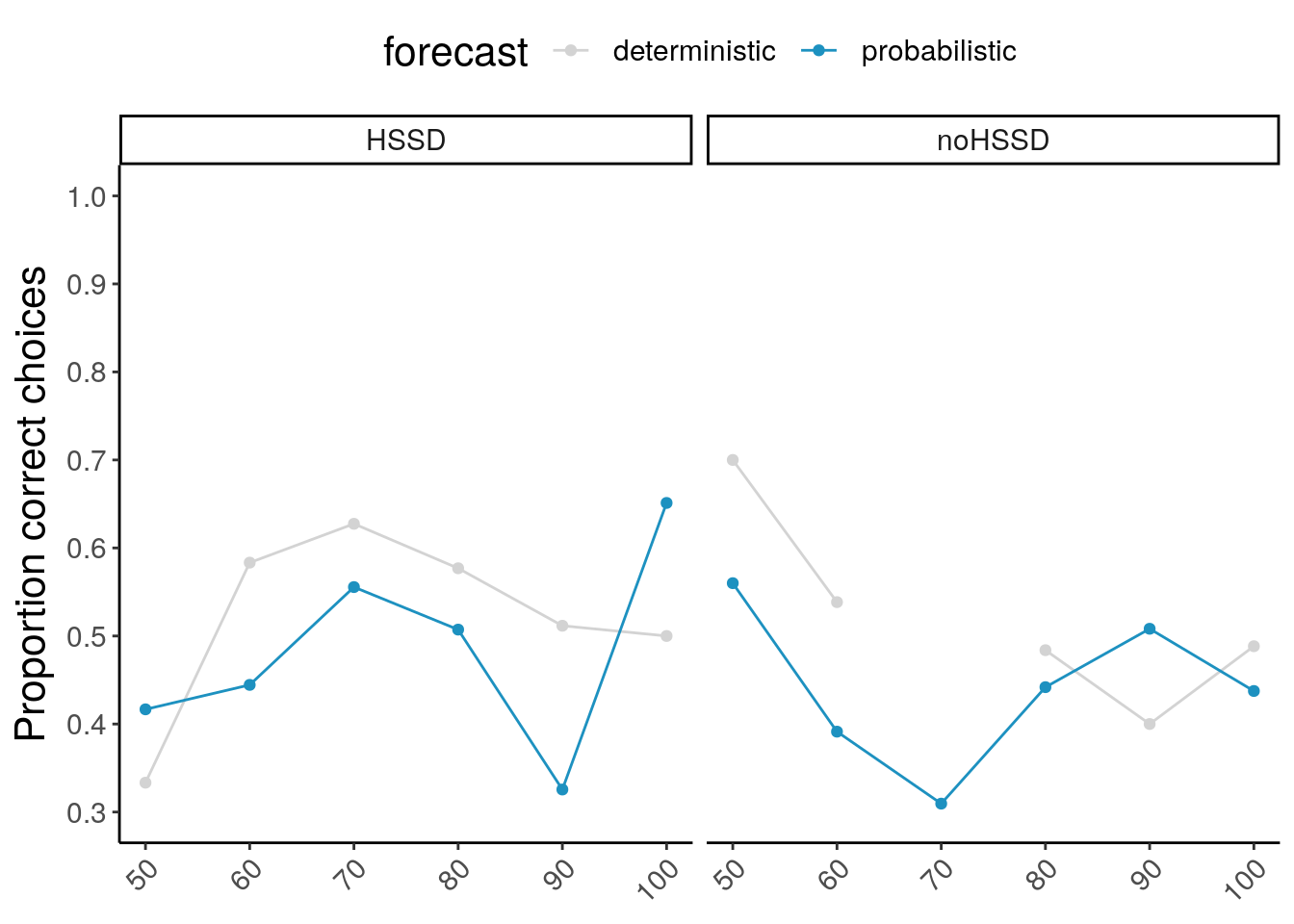

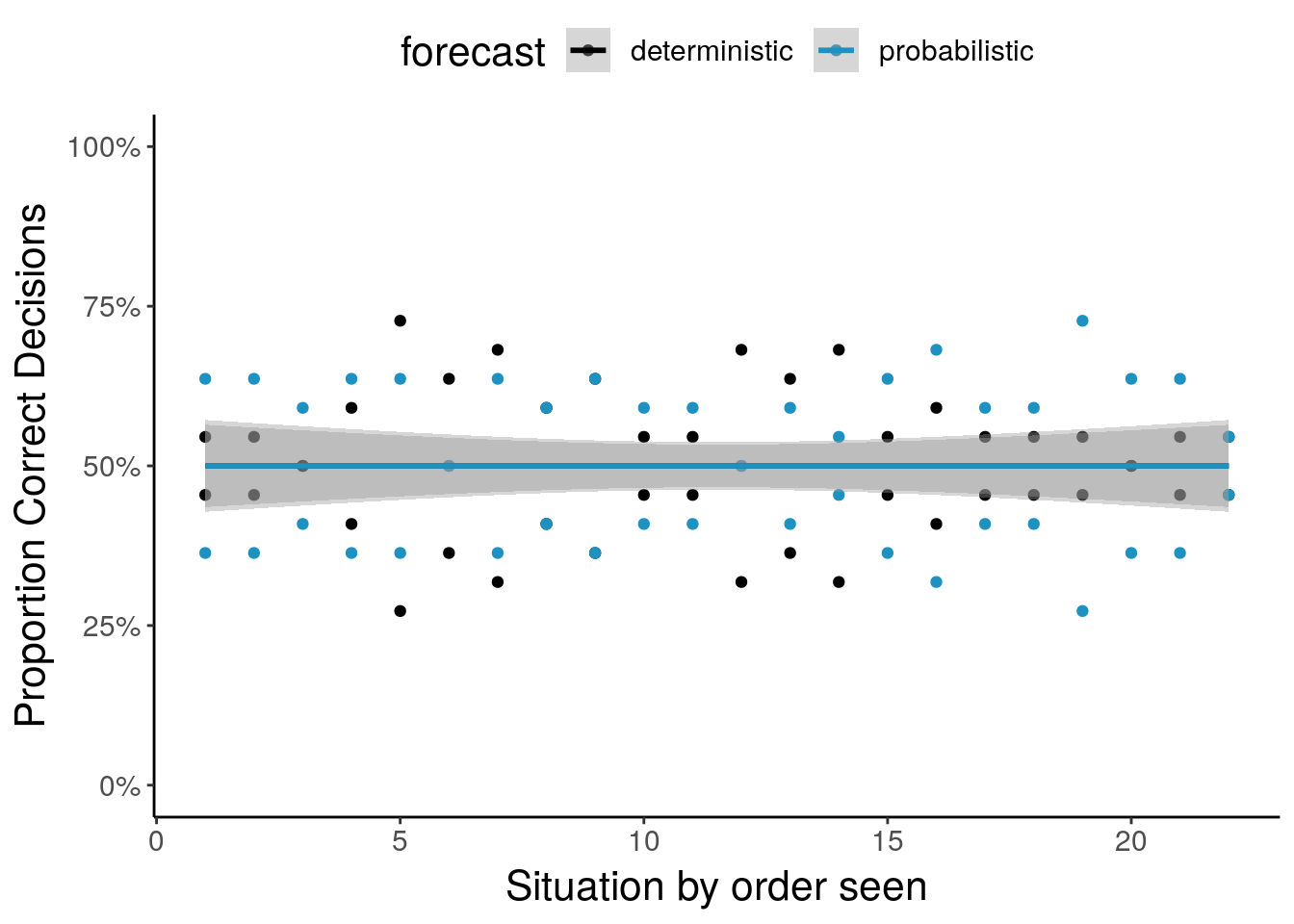

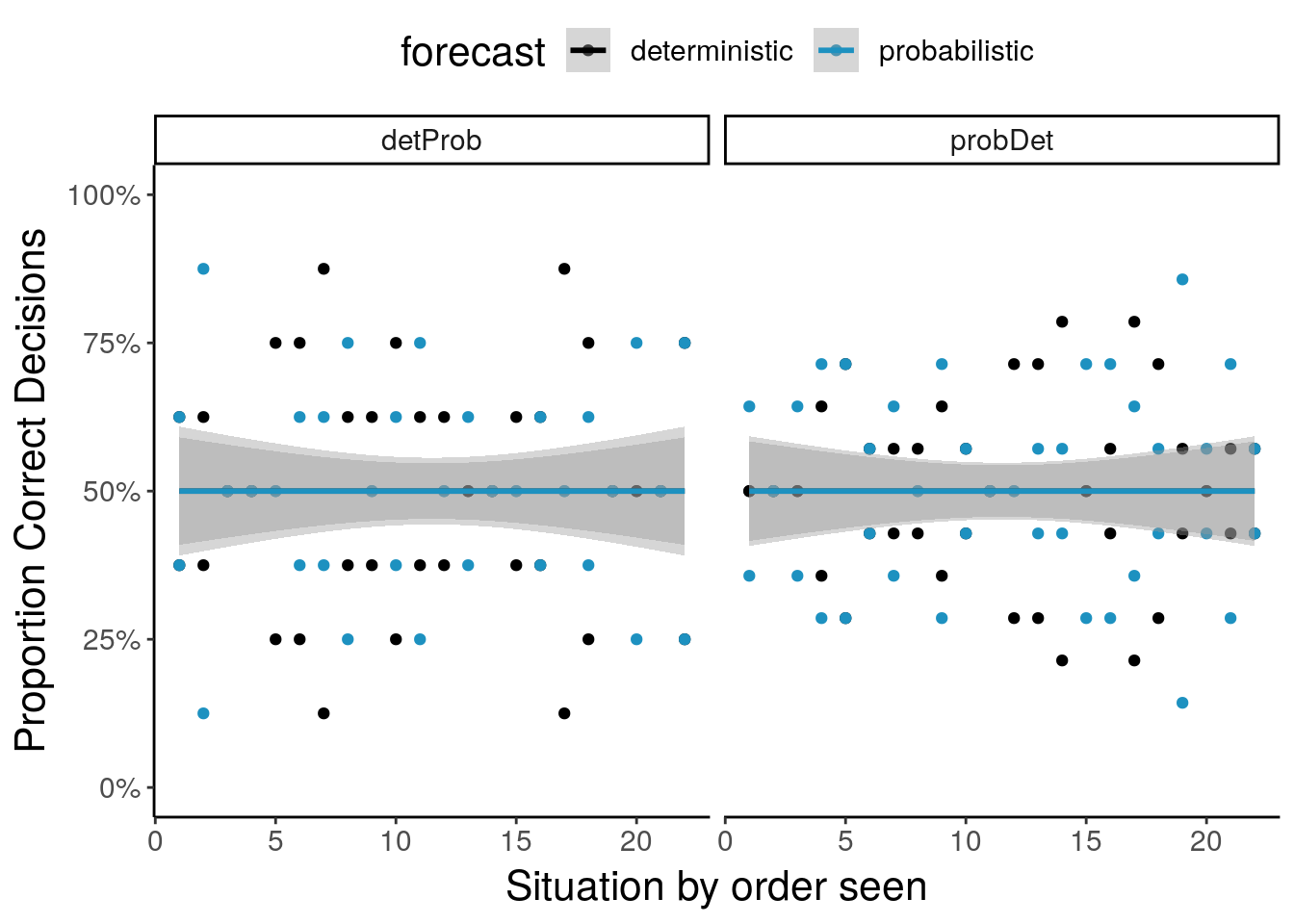

Proportion correct

Proportion of correct decisions with deterministic vs. probabilistic forecasts

Correct here means to trade 100% when there is no HSSD, and to trade 50% when there is a HSSD. However, given that people make decisions rather than a categorization judgment, there is strictly speaking no correct or incorrect because what is right or wrong depends on the payoffs, risk preference and strategy of the person. E.g. it can be perfect for someone to use a very risk averse safe strategy.

# A tibble: 4 x 3

# Groups: event, forecast [4]

event forecast n

<chr> <chr> <int>

1 event deterministic 242

2 event probabilistic 242

3 noEvent deterministic 242

4 noEvent probabilistic 242

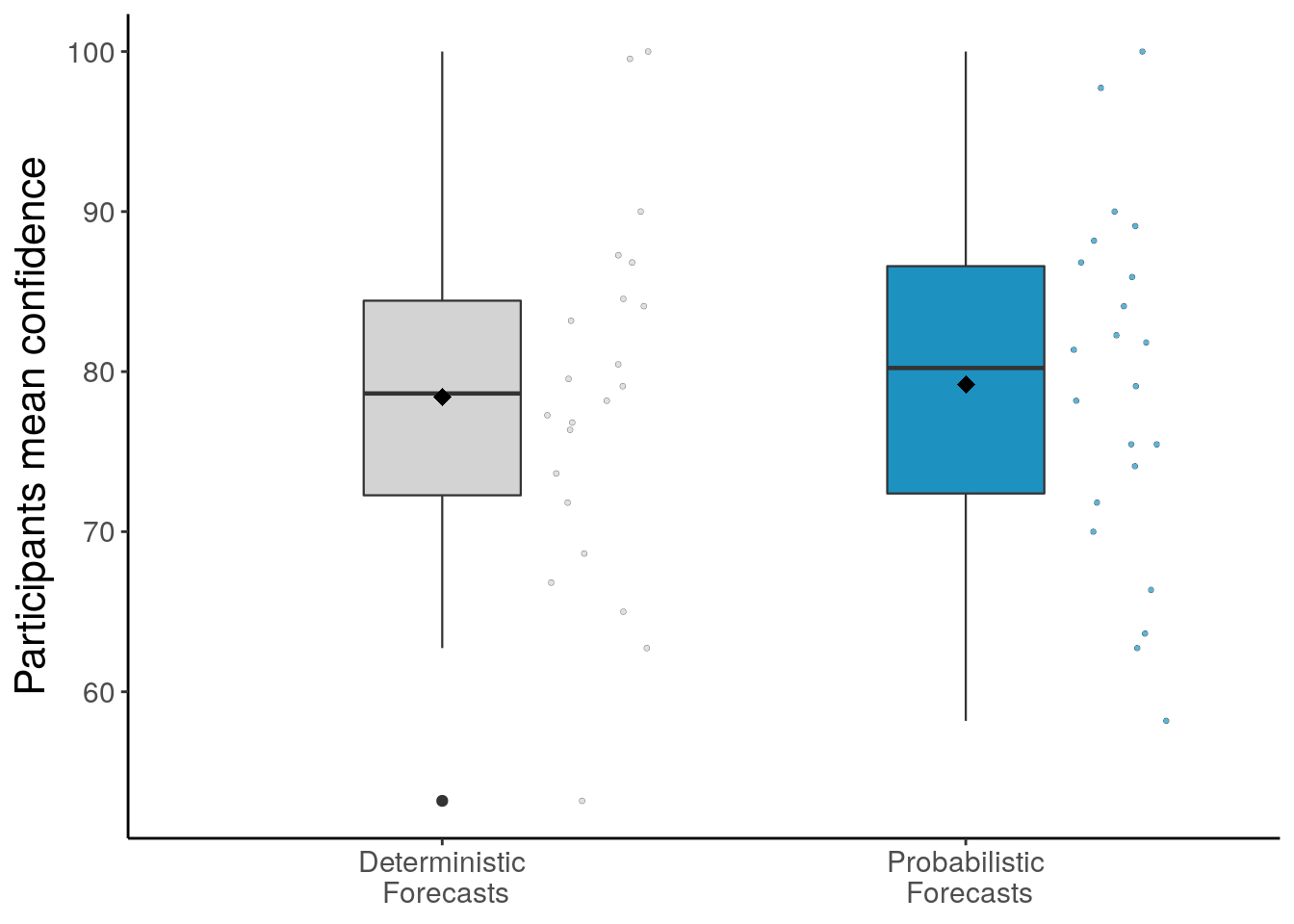

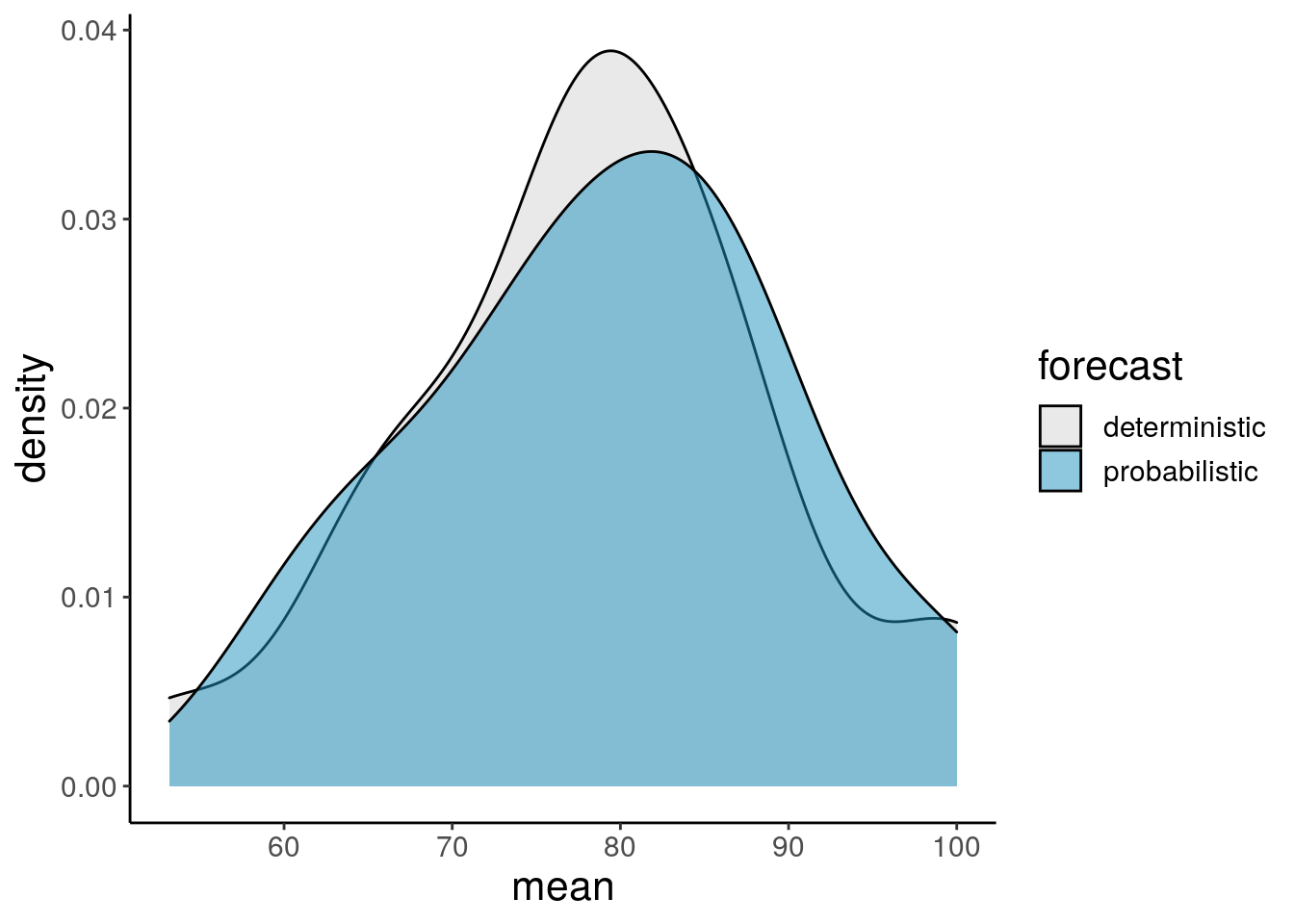

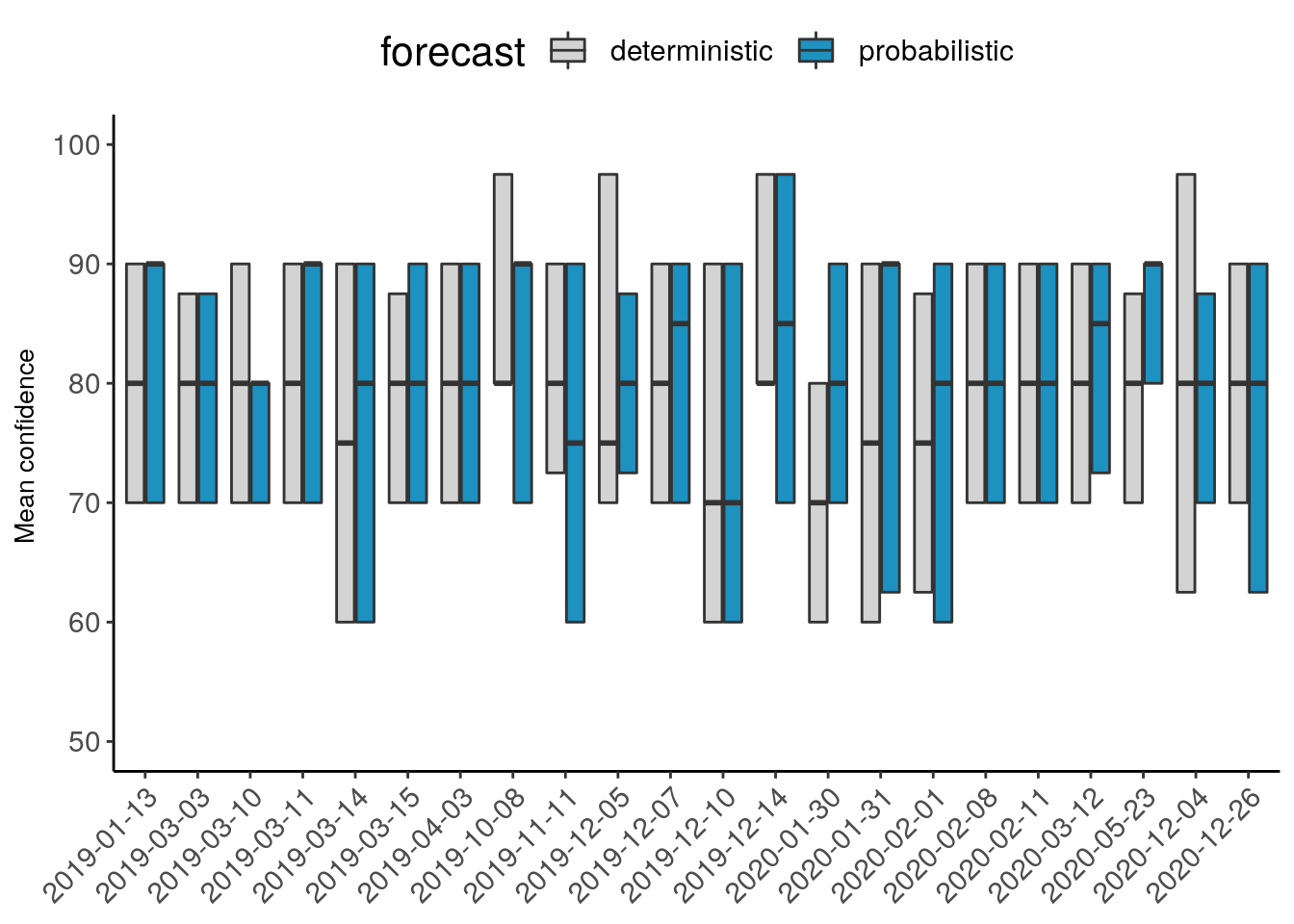

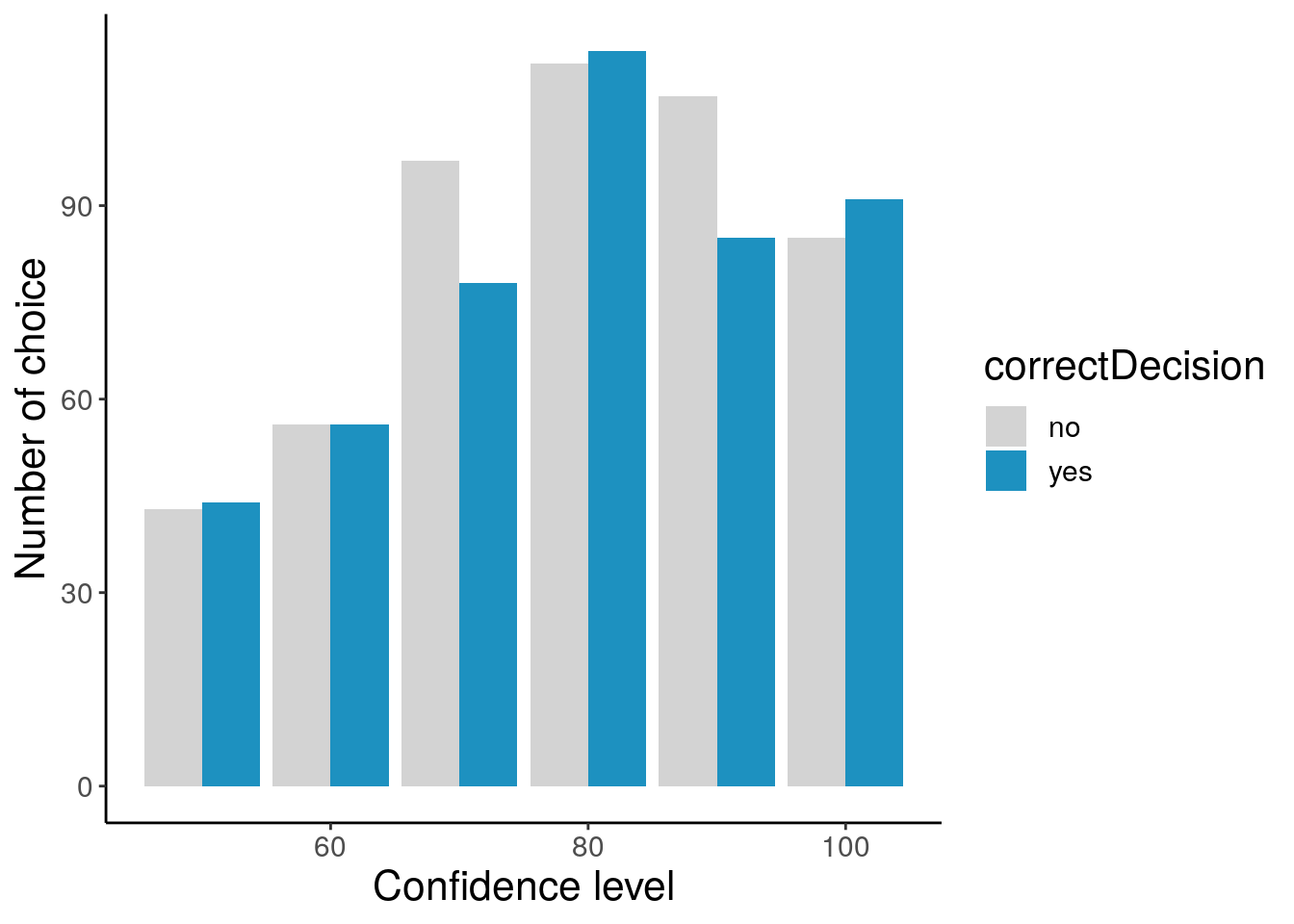

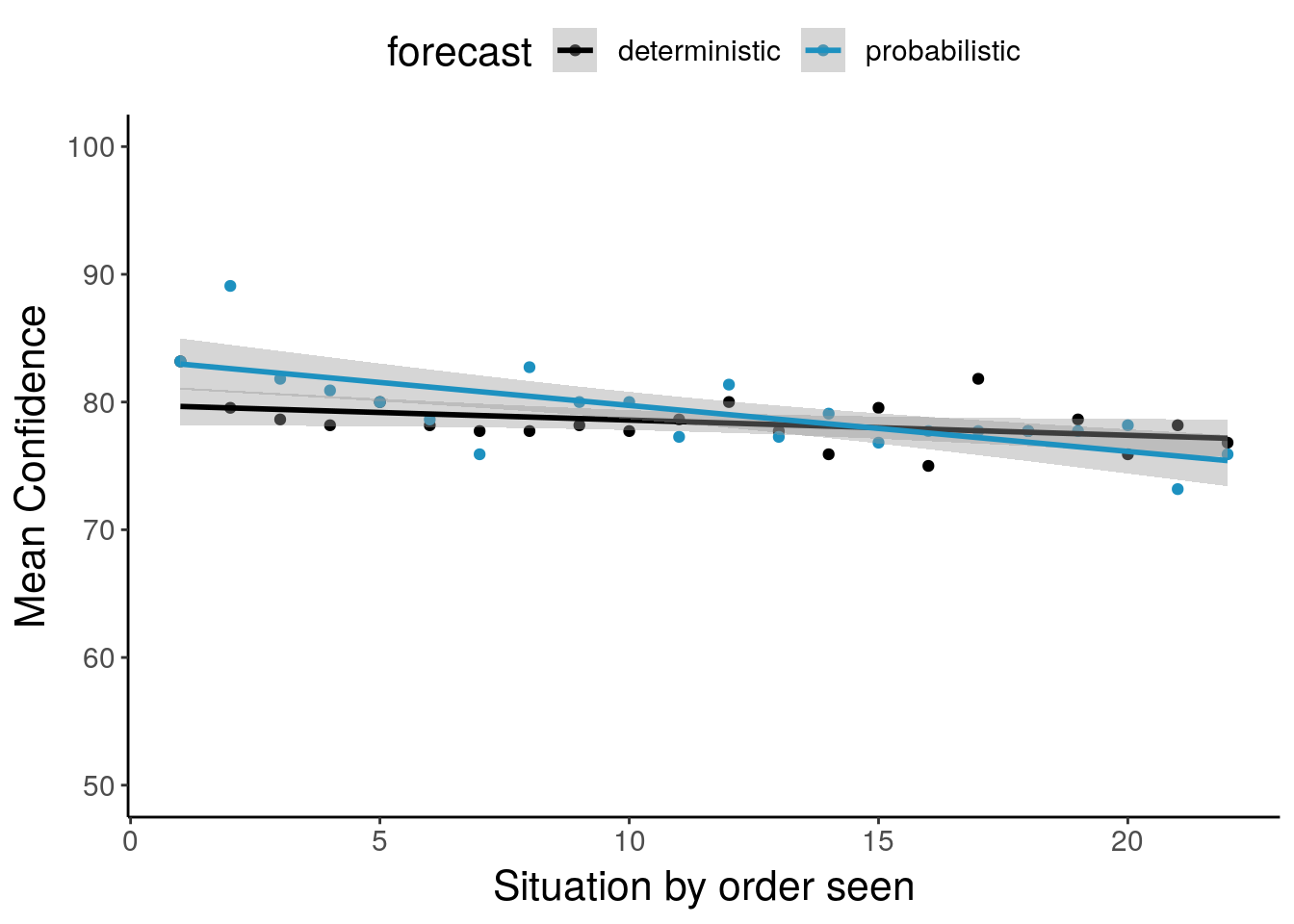

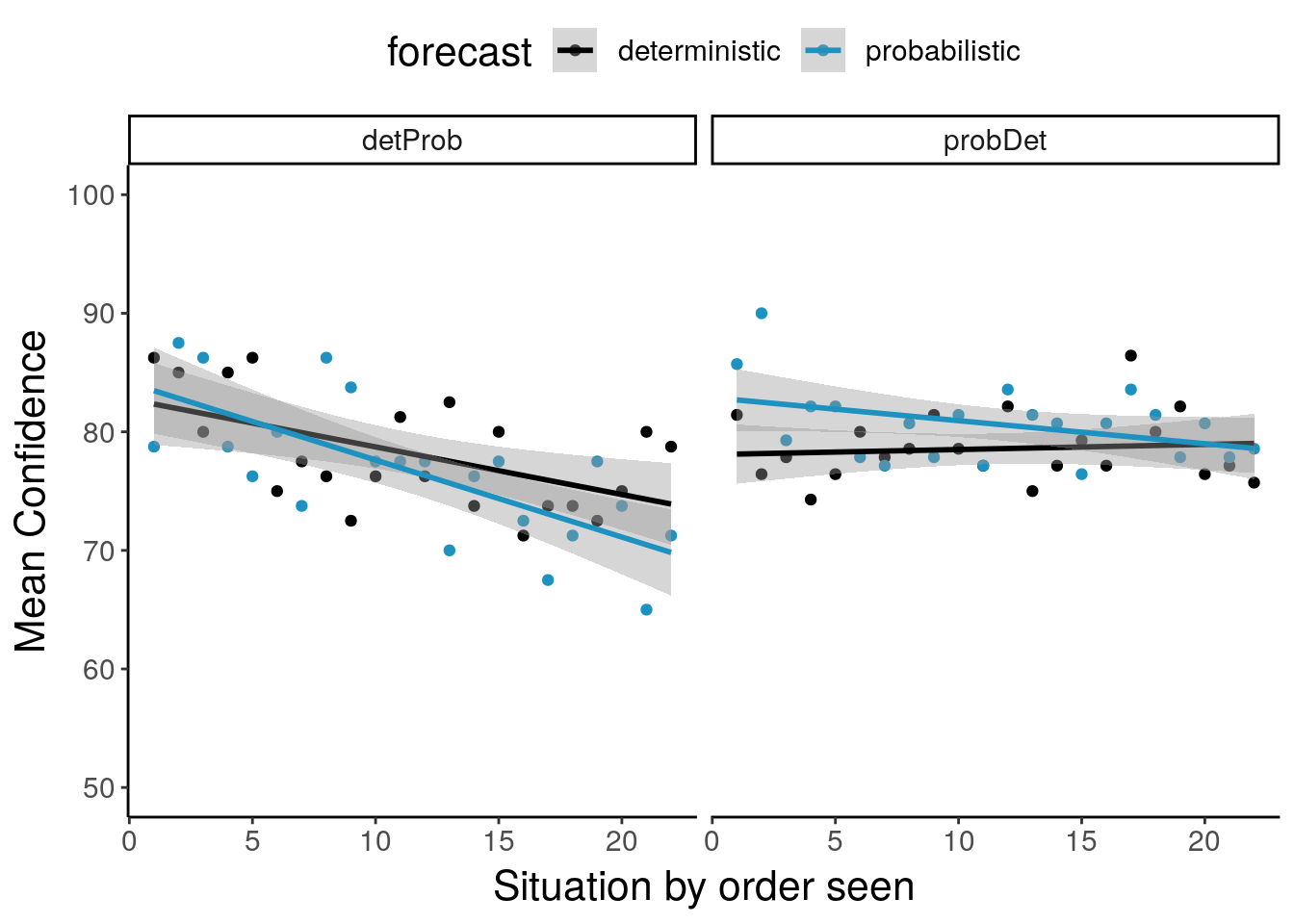

Confidence

Distribution of mean confidence per participant and per situation

Min. 1st Qu. Median Mean 3rd Qu. Max.

53 72 79 78 84 100 Min. 1st Qu. Median Mean 3rd Qu. Max.

58 72 80 79 87 100

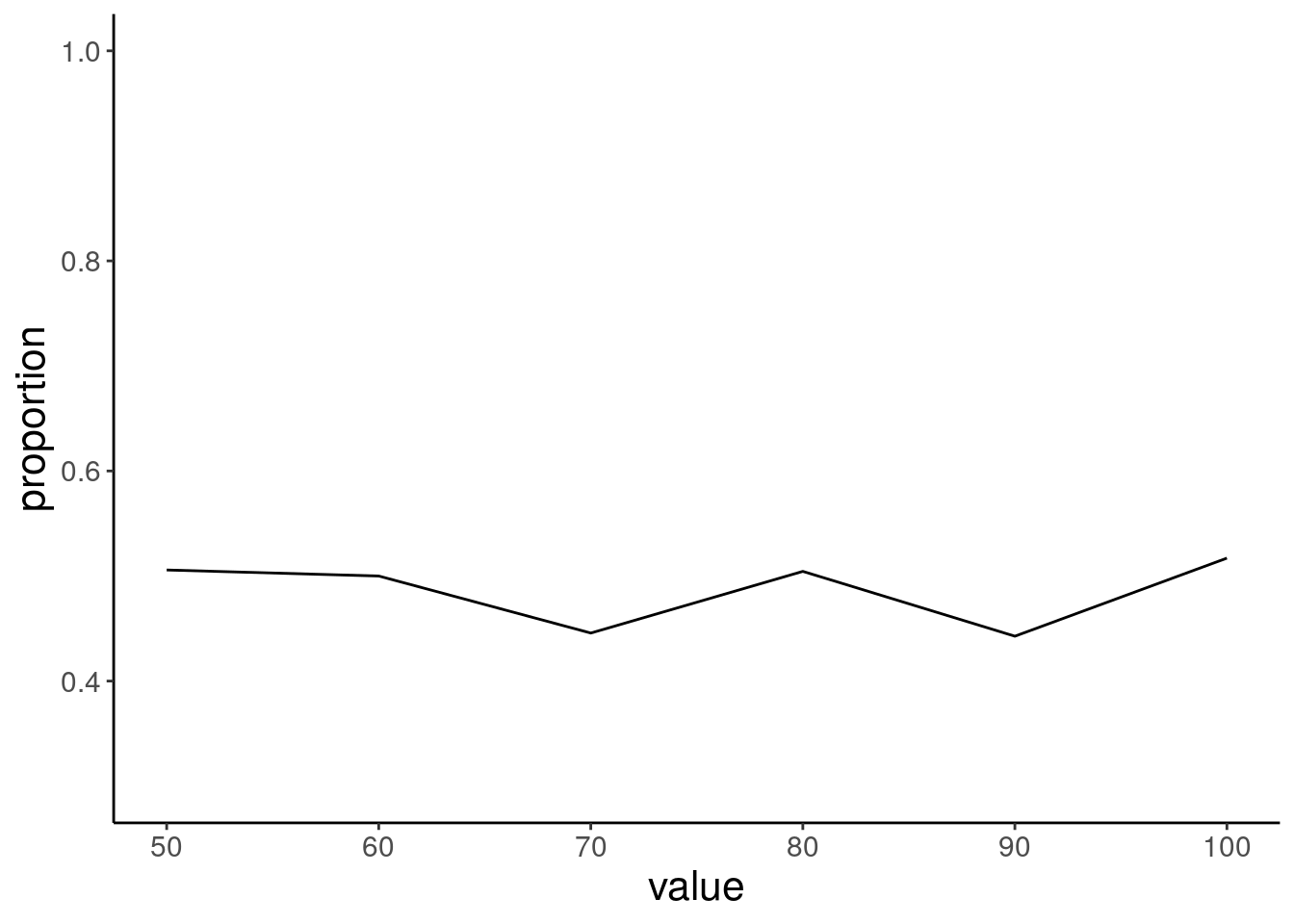

Calibration of confidence

Distribution of confidence values

Relation of confidence to proportion correct decisions: Proportion correct for each confidence level across participants

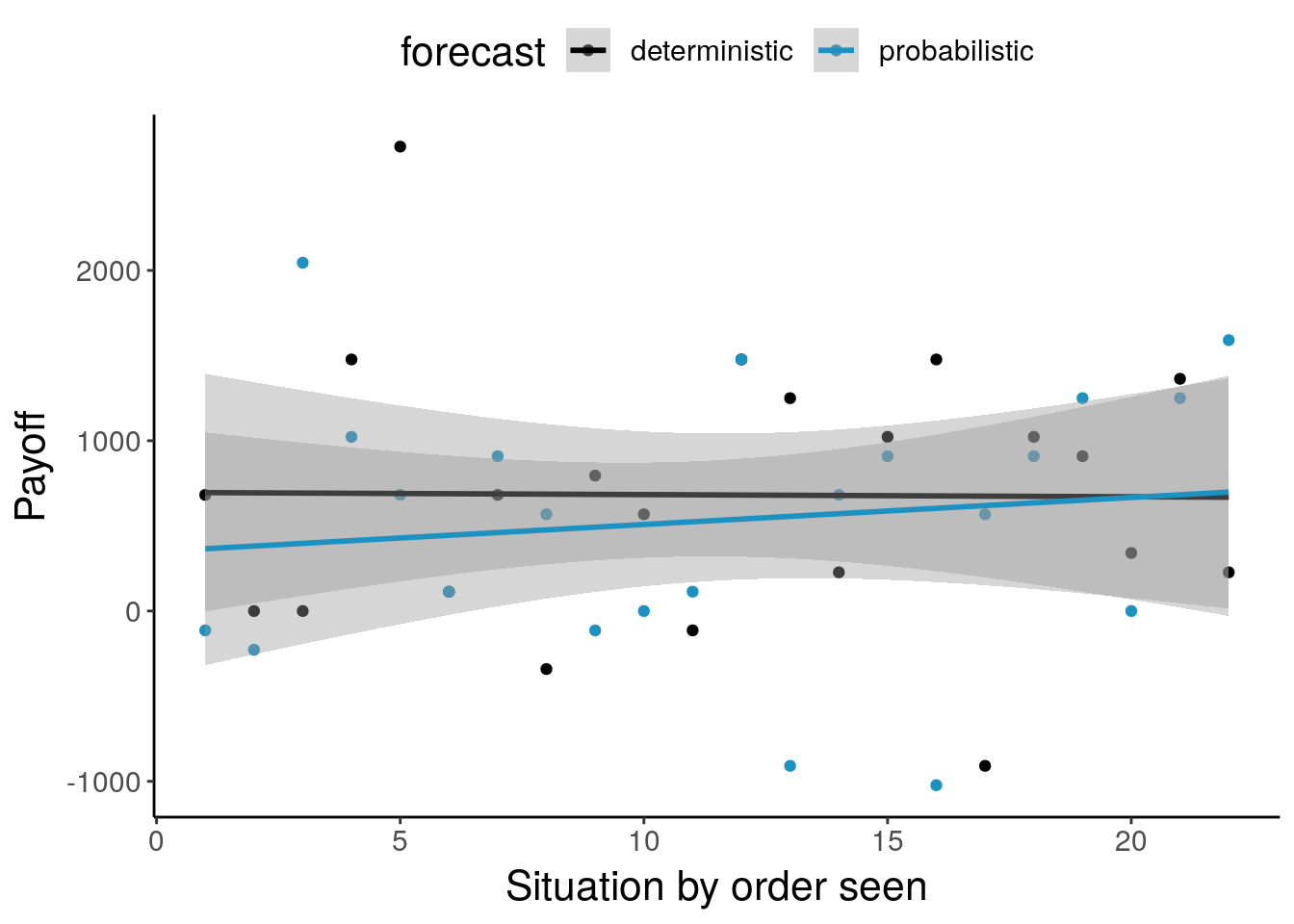

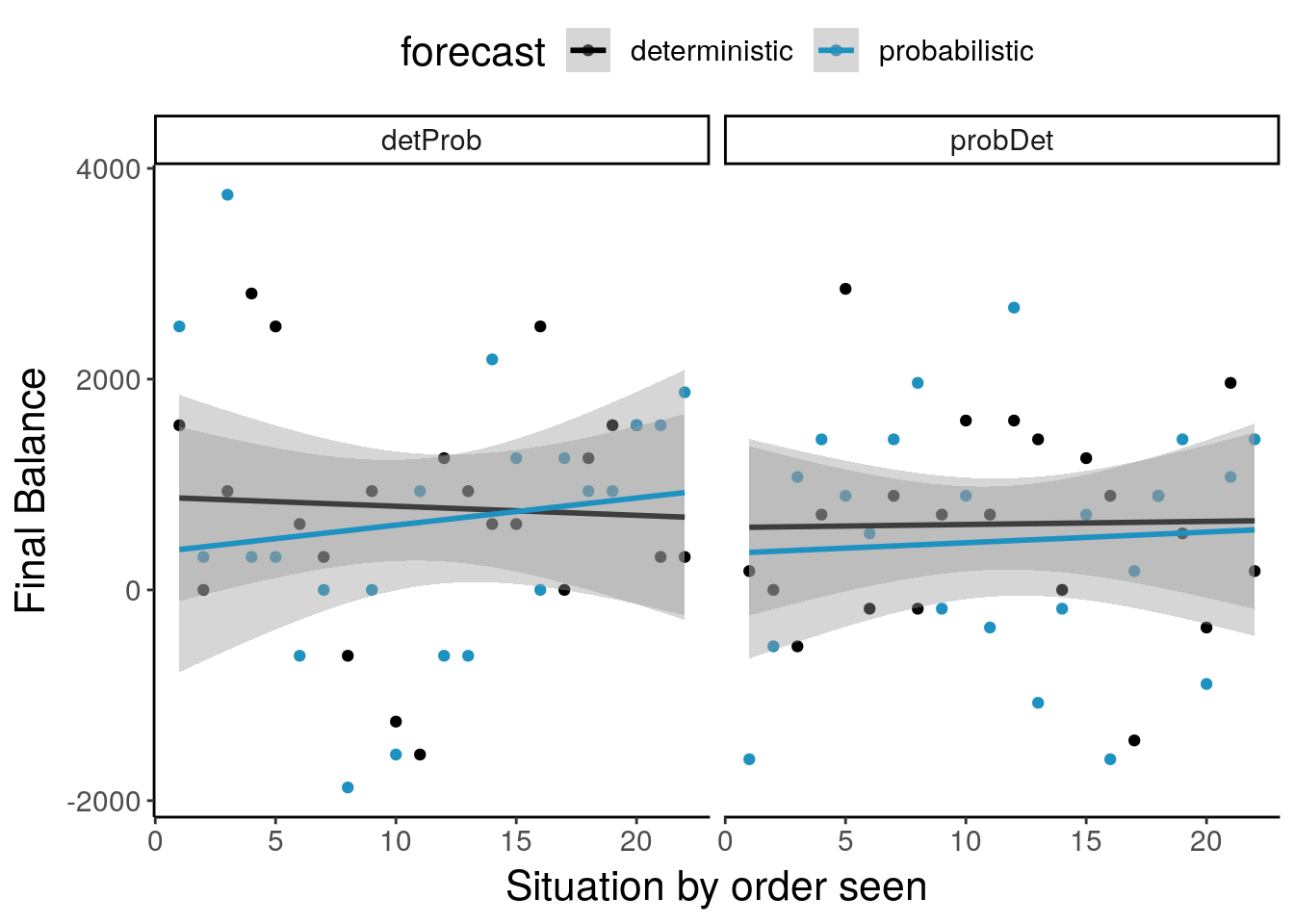

Learning

Learning curves for payoffs, proportion correct, safe choices and confidence

Strategies

Decision strategies & HSSD indicators

R Markdown website has been created using workflowr (external link)

Imprint

Privacy Policy